Sustainable finance, once heralded as the future of investing, is facing an unexpected downturn. Environmental, Social, and Governance (ESG) funds, which have been at the forefront of responsible investing, are experiencing a significant slowdown in 2024. After years of robust growth, the dramatic halt in their expansion raises critical questions about the future of sustainable finance and the broader implications for the financial sector.

The Great ESG Slowdown: Trends and Figures

The ESG funds market, once booming with activity, is now witnessing an unprecedented decline. In the first half of 2024, the number of new ESG fund launches dropped by 50% compared to the same period in 2023. According to Morningstar data, only 170 ESG funds were launched globally in the first six months of the year, a stark contrast to the 325 in 2023 and the record 529 in 2022.

This downturn is not uniform across all regions. Europe, while affected, remains the undisputed leader in sustainable finance. The continent still accounts for 84% of global ESG assets, with $2.6 trillion under management. Additionally, Europe was responsible for 75% of the new sustainable funds launched in the first half of 2024.

In contrast, the United States is particularly hard-hit by this downward trend. The American market continues to see its ESG assets shrink, albeit at a slower pace than before. Notably, only six new ESG funds were launched in the U.S. during the first half of 2024, reflecting American investors’ growing caution toward this segment.

Factors Behind the Steep Decline

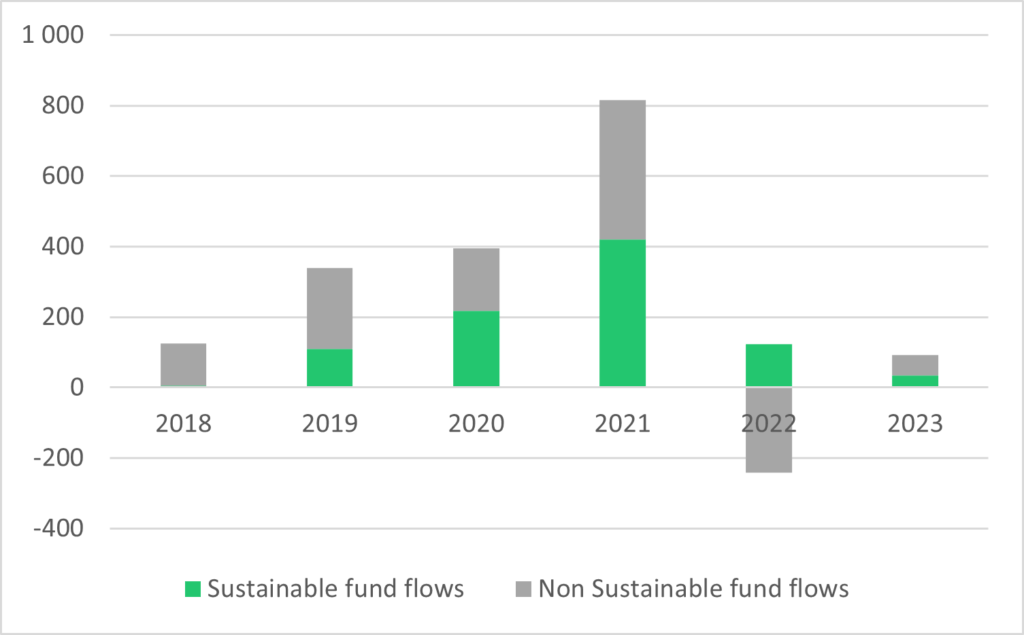

Several factors contribute to this sudden slowdown in ESG fund growth. Firstly, the market is undergoing a normalization process after three years of rapid expansion, during which nearly every asset management firm rushed to launch sustainable funds to meet rising demand.

Hortense Bioy, Director of Sustainable Investment at Morningstar Sustainalytics, explains, “We are witnessing a normalization of activity after three years of strong growth, during which almost every asset management company hastened to launch sustainable funds to meet growing demand.”

Regulatory uncertainty also plays a significant role in this slowdown. In Europe, the overhaul of the Sustainable Finance Disclosure Regulation (SFDR) has already necessitated numerous reclassifications. Asset managers are waiting for clearer guidelines before launching new products, a clarity that could take several years to materialize.

Moreover, greenwashing scandals have left lasting scars. The year 2022 was marked by several high-profile cases, shaking investor confidence in ESG products. This skepticism was further exacerbated by the disappointing performance of many ESG funds in 2022, driven by the surge in oil prices and the decline in technology stocks, which are typically overweight in these portfolios.

As a result, asset management firms are now adopting a more selective and tactical approach to their new product strategies. They are focusing on consolidating existing ranges rather than multiplying launches, prioritizing quality over quantity.

The ESG Survivors: Who’s Weathering the Storm?

Despite the challenging environment, some players manage to stand out. Europe, although affected by the slowdown, shows signs of resilience. In the second quarter of 2024, European sustainable funds attracted $11.8 billion.

Among the major market players, strategies vary. BlackRock, the world’s largest asset manager, has significantly reduced its launches, going from 61 new ESG funds in 2021 to just four by the end of May 2024. Similarly, German firm DWS and American company Invesco have dramatically slowed their activity in this area.

However, two French giants are bucking the trend. Amundi, Europe’s largest asset management company, launched six new ESG funds in 2024, while BNP Paribas Asset Management created twelve. This resilience of French players underscores their ongoing commitment to responsible finance despite the market’s turbulence.

These asset management firms are adapting their strategies to meet the market’s new demands. They are betting on innovation and transparency to regain investor confidence while anticipating future regulatory developments.

Navigating the Future: Recommendations for Sustainable Growth in ESG Investing

As the ESG market navigates this period of uncertainty, it is crucial for investors and asset managers alike to focus on long-term sustainability while growing their capital in the stock market. Here are some key recommendations:

- Diversify ESG Investments: To weather the volatility in the ESG market, diversify investments across different sectors and regions. This approach not only reduces risk but also allows investors to capitalize on the strengths of various markets.

- Focus on Quality Over Quantity: Asset managers should prioritize the quality of ESG funds over the sheer number of offerings. By focusing on funds with strong, transparent ESG credentials, investors can build a more resilient portfolio.

- Enhance Transparency and Communication: In the wake of greenwashing scandals, transparency is more important than ever. Asset managers should clearly communicate the ESG criteria used in their funds and provide regular updates on performance against these criteria.

- Adapt to Regulatory Changes: With regulatory frameworks in flux, staying ahead of compliance requirements is essential. Asset managers should work closely with regulators and industry bodies to ensure their products meet the highest standards of sustainability.

- Invest in Innovation: As the market evolves, there will be new opportunities for innovative ESG products. Asset managers should invest in research and development to create funds that address emerging environmental and social challenges.

- Support Sustainable Corporate Practices: Investors should focus on companies that not only meet ESG criteria but also demonstrate a commitment to long-term sustainability. By investing in such companies, investors can contribute to positive environmental and social outcomes while achieving financial returns.

- Monitor Market Trends: The ESG market is dynamic and subject to rapid changes. Investors and asset managers should closely monitor market trends and be prepared to adjust their strategies in response to new developments.

Conclusion: The Future of Sustainable Finance

The sharp decline in ESG funds in 2024 is a wake-up call for the sustainable finance sector. While the market is undergoing a period of normalization and adjustment, the fundamental principles of responsible investing remain crucial for long-term success.

By focusing on quality, transparency, and innovation, asset managers can navigate the challenges of the current market and position themselves for future growth. Investors, in turn, should remain committed to sustainable finance, recognizing that the path to sustainability is not always smooth, but it is ultimately rewarding.

As the world continues to grapple with environmental and social challenges, the need for sustainable finance will only grow. By adapting to changing conditions and staying true to the core values of ESG investing, the sector can emerge stronger and more resilient in the years to come.

Related Content

- Embracing ESG: The Cornerstone of Sustainable Development

- Sustainability Initiatives Gain Momentum: EcoOnline Survey Reveals Promising Trends in Corporate Environmental Responsibility

- Navigating the Ecological Crisis: Current Challenges and Action Plan for a Sustainable Future

- Sustainability Trends to Watch in 2024: Key Issues Shaping the Future

- Navigating the Future: A Look at Growth Potential and Sustainability in Key Stocks

- The Future of Renewable Energy: Innovations and Challenges

- ESG at a Crossroads – The Darden Report

- ESG backlash seen in sharp decline of fund launches

- ESG at a Crossroads: Down, But Not Out

- Backlash Against ESG Seen in Sharp Decline of Fund …

- Is Sustainable Finance at a Crossroads?