Financial giant BlackRock’s recent foray into Real-World Asset (RWA) cryptocurrencies signifies a potential turning point for the industry. Estimates predict the RWA market to reach a staggering $10 trillion by 2030 (21.co), highlighting its immense potential.

This article explores this exciting space and offers a conservative yet realistic prediction of the RWA crypto landscape by 2025, based on the current momentum, including BlackRock’s involvement.

Note: Acquiring RWA cryptocurrencies proves challenging on conventional platforms. A viable option is utilizing TrustWallet or more established platforms like Crypto.com.

- TrustWallet is a popular mobile wallet application that provides users with a secure and intuitive platform to store, send, receive, and trade cryptocurrencies. Developed by Binance, one of the leading cryptocurrency exchanges globally, TrustWallet supports a wide range of digital assets, including Bitcoin, Ethereum, and various ERC-20 tokens. It boasts robust security features such as encryption and biometric authentication, ensuring the safety of users’ funds. Moreover, TrustWallet offers decentralized finance (DeFi) capabilities, enabling users to participate in decentralized exchanges (DEXs) and access various decentralized applications (dApps) directly from the app.

- Crypto.com is a comprehensive cryptocurrency platform offering a multitude of services, including a cryptocurrency exchange, wallet app, Visa card with cashback rewards in cryptocurrency, DeFi capabilities, and more. With a user-friendly interface and a range of supported cryptocurrencies, Crypto.com aims to make cryptocurrency accessible to everyone, offering features like staking, lending, and high-yield savings accounts. Additionally, Crypto.com provides various educational resources and tools to help users navigate the complex world of cryptocurrencies effectively.

The Rise of RWA Cryptos

BlackRock’s move validates RWA cryptos as a legitimate asset class. These cryptocurrencies are backed by real-world assets like real estate, commodities, or even intellectual property. This backing offers a layer of stability compared to traditional cryptocurrencies.

Growth and Mainstream Adoption (2025 Prediction)

By 2025, we can expect significant growth in the RWA crypto market, fueled by:

- More Institutional Investors: BlackRock’s entry paves the way for other major institutions to follow suit, injecting significant capital and fostering legitimacy.

- Regulatory Clarity: As regulations evolve, RWA cryptos will become more attractive to mainstream investors, driving broader adoption.

Increased Interoperability and Efficiency

Improved interoperability between blockchain networks is likely by 2025. This will enhance communication and data exchange within the RWA crypto ecosystem, leading to:

- Increased Liquidity: Easier movement of assets between different platforms will improve overall liquidity in the market.

- Enhanced Efficiency: Streamlined operations will lead to faster transactions and reduced costs.

Tokenization of Diverse Assets

The trend of tokenizing various real-world assets is likely to gain traction. We can expect to see:

- Real Estate: Brick-and-mortar investments becoming more accessible through fractional ownership via tokenization.

- Commodities: Easier investment opportunities in commodities like gold or oil through tokenized representations.

- Intellectual Property: Streamlined ownership and monetization of intellectual property through tokenization.

DeFi Integration and Financial Inclusion

The integration of Decentralized Finance (DeFi) solutions within the RWA crypto space is likely to expand by 2025. This could lead to:

- Broader Financial Access: DeFi protocols can offer financial services like lending and borrowing to a wider audience, potentially reaching underserved communities.

- Investment Opportunities: Increased DeFi integration could create innovative investment products for a broader range of investors.

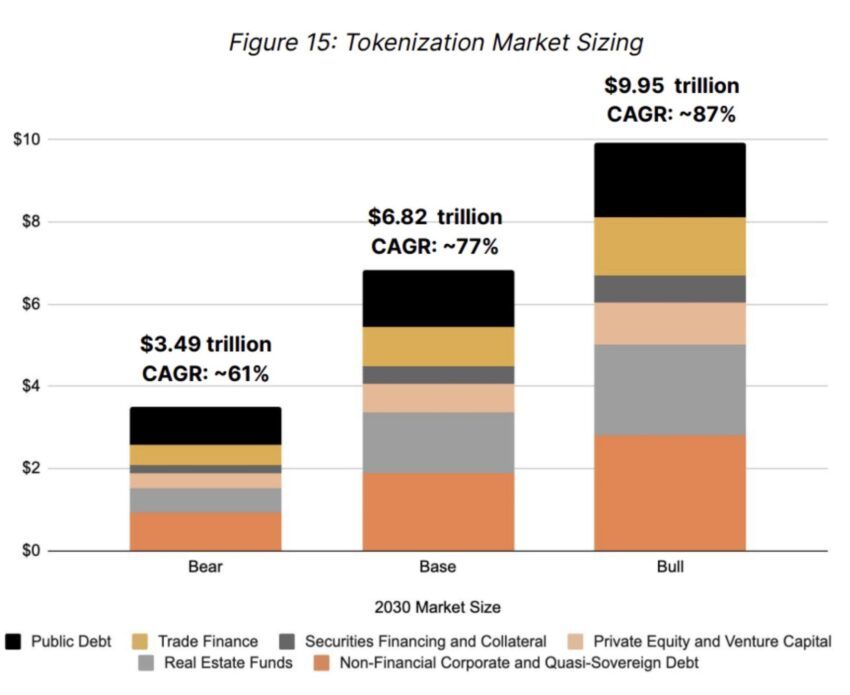

The RWA crypto market is projected to experience explosive growth by 2030, with estimates suggesting a potential market capitalization exceeding $10 trillion (source: 21.co). This surge will be fueled by the increasing participation of institutional investors and the tokenization of a wider range of real-world assets. Traditional financial sectors like Real Estate Funds, Private Equity, Securities Financing & Collateral, and Trade Finance are all poised to be significantly impacted by RWA cryptos.

Here’s the breakdown:

- Real Estate Funds: RWA cryptos can enable fractional ownership of real estate, making these funds more accessible to a broader investor base.

- Private Equity: RWA cryptos can improve the liquidity of private equity investments by facilitating easier secondary market trading.

- Securities Financing & Collateral: RWA cryptos can streamline the process of using real-world assets as collateral for loans and other financial transactions.

- Trade Finance: RWA cryptos can create a more efficient and transparent trade finance ecosystem by tokenizing trade receivables and payables.

This integration between RWA cryptos and traditional financial sectors will unlock new opportunities for investors, businesses, and the global economy as a whole.

A Conservative Outlook

While the predictions above outline a promising future, it’s important to maintain a conservative outlook. The crypto market is still relatively young, and unforeseen regulatory changes or technological advancements could impact these predictions.

Forecast for promising RWA Cryptos

Realio (RIO)

Realio is a platform that bridges the gap between traditional investments and the decentralized world of web 3. It offers a regulated and open architecture that allows investors to access types of investments typically reserved for large investors, such as real estate and private equity.

Forecast:

- 2025: Realio could see significant growth as more institutional investors enter the RWA crypto space. The platform’s focus on real estate and private equity could be particularly attractive to these investors.

- 2030: Realio could become a major player in the RWA crypto market, with a market capitalization of $1 billion or more. The platform’s focus on compliance and regulation could make it a trusted choice for investors.

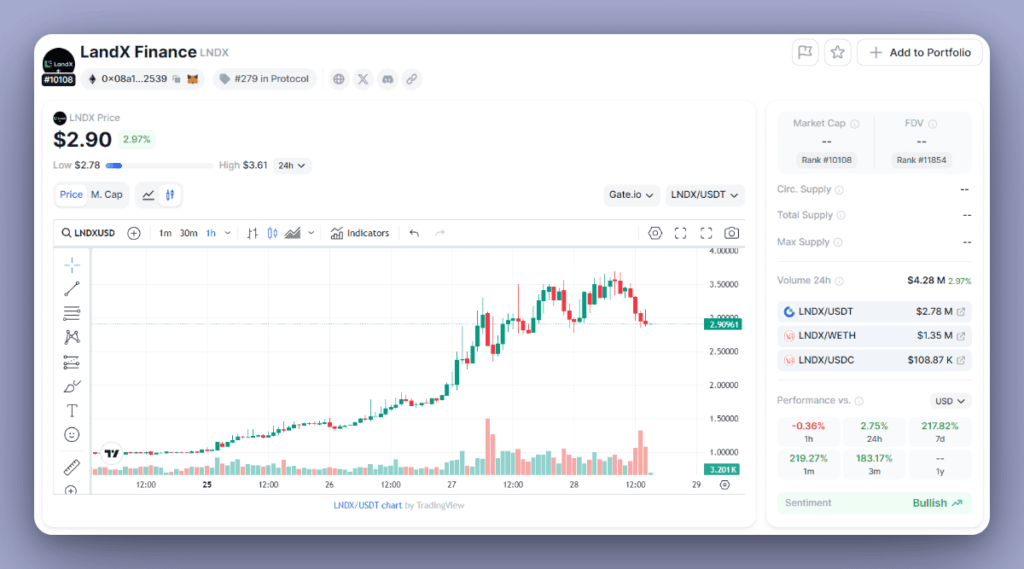

LandX (LNDX)

LandX is a platform that provides access to decentralized finance (DeFi) for the agricultural sector. It allows farmers to tokenize crop shares as collateral for loans, providing them with an alternative to traditional financing methods.

Forecast:

- 2025: LandX could see significant growth as the demand for DeFi solutions in the agricultural sector increases. The platform’s focus on sustainability and security could make it a popular choice for farmers.

- 2030: LandX could become a major player in the agricultural DeFi market, with a market capitalization of $100 million or more. The platform’s focus on emerging markets could make it a key player in the global food supply chain.

Polytrade (TRADE)

Polytrade is a decentralized protocol that aims to revolutionize the debt financing market. It offers a variety of assets, ranging from Treasury bills to luxury goods, and seeks to interconnect all market participants to facilitate a coherent and integrated trading experience.

Forecast:

- 2025: Polytrade could see significant growth as the demand for RWA-backed cryptocurrencies increases. The platform’s focus on debt financing could make it a popular choice for investors seeking alternative investment options.

- 2030: Polytrade could become a major player in the RWA crypto market, with a market capitalization of $1 billion or more. The platform’s focus on interoperability and efficiency could make it a key player in the global financial system.

Nexera (NXRA)

Nexera is a platform that combines blockchain technology with traditional finance. It focuses on improving the efficiency and compliance of cross-border transactions in capital markets.

Forecast:

- 2025: Nexera could see significant growth as the demand for cross-border financial services increases. The platform’s focus on compliance and regulation could make it a trusted choice for businesses and individuals.

- 2030: Nexera could become a major player in the global financial market, with a market capitalization of $10 billion or more. The platform’s focus on blockchain technology could make it a key player in the future of finance.

Creditcoin (CTC)

Creditcoin is a platform that aims to establish an international credit network. It seeks to connect emerging markets to the liquidity of developed economies, creating a more open and inclusive financial system.

Forecast:

- 2025: Creditcoin could see significant growth as the demand for credit in emerging markets increases. The platform’s focus on financial inclusion could make it a popular choice for individuals and businesses in these markets.

- 2030: Creditcoin could become a major player in the global credit market, with a market capitalization of $100 billion or more. The platform’s focus on blockchain technology could make it a key player in the future of finance.

In Short

BlackRock’s move into RWA cryptos signifies a major step towards mainstream adoption. While the full impact will unfold over time, the next few years are likely to see significant growth in the RWA crypto market, offering exciting opportunities for investors and the financial sector as a whole.

The five cryptos listed above are all well-positioned to benefit from the growth of the RWA crypto market. Each platform has its own unique strengths and focus areas, which could make it a good choice for different types of investors. It is important to remember that the crypto market is still relatively young and volatile. As such, it is important to do your own research before investing in any cryptocurrencies.

Related Links

- Decoding Crypto Craze: Unraveling Investor Behavior Through a Comprehensive Literature Review

- Unlocking the Future: Crypto Trends and the AI Revolution

- Exploring the Synergy of Cryptocurrency and Artificial Intelligence: A Comparative Analysis of Pepe, JasmyCoin, Iota, Mina, Maker, Fetch.AI, and Oasis Network

- Blockchain Applications Beyond Cryptocurrency: Real-World Use Cases

- Riding the Wave: Exploring the Super exponential Long-Term Trends of Information Technology

- Why RWA Crypto Tokens Are Exploding: Unveiling the Hype Behind RWA Coins (99bitcoins.com)

- Top 3 other RWA Tokens Whales Are Buying For 100X Profit In 2024

- Here Are 12 RWA Coins Accumulated By BlackRock | Crypto PM on Binance Square

- RWA Ondo will use BlackRock’s Ethereum-Based BUIDL Fund to Back Its T-Bill Token OUSG

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency investments are highly speculative and involve significant risks.

Micro2media does not endorse or recommend any specific cryptocurrency investment or trading strategy. We do not guarantee the accuracy, completeness, or reliability of any information presented in this article.

Investing in cryptocurrencies carries the risk of loss, including the loss of principal. Prices of cryptocurrencies are highly volatile and can fluctuate widely in a short period.

Before making any investment decisions, it is important to conduct thorough research and seek advice from a qualified financial advisor. Only invest what you can afford to lose.

Micro2media is not responsible for any losses incurred as a result of investing in cryptocurrencies. Users are solely responsible for their investment decisions and should exercise caution and diligence when engaging in cryptocurrency trading or investment activities.