Quantum computing (QC) is no longer a fringe academic pursuit; it is the ultimate disruptive force, rapidly moving from laboratory theory to commercial reality. For investors, this sector represents the highest-stakes, highest-reward proposition of the decade. We are not just buying shares in a technology; we are betting on the speed at which we can solve humanity’s toughest challenges—from optimizing global logistics to inventing the perfect battery for a net-zero future.

As of October 2025, the publicly traded quantum landscape is dominated by three unique players, each pursuing a fundamentally different architectural path to supremacy: IonQ, Rigetti Computing, and D-Wave Quantum.

Comparing these companies requires moving beyond traditional metrics like P/E ratios (which are often irrelevant for pre-profit innovators) and focusing on three critical vectors: technological promise, current revenue stability, and long-term sustainability impact. The winner in this race will define the 21st century’s computational economy, but all three are vital assets in the global fight against climate change.

1. The Quantum Divide: Comparing Architectural Solutions

The primary difference between these three firms lies in the physical foundation upon which they build their qubits—the quantum equivalent of a classical bit. Each architecture presents a unique set of trade-offs regarding stability, error rates, and scalability.

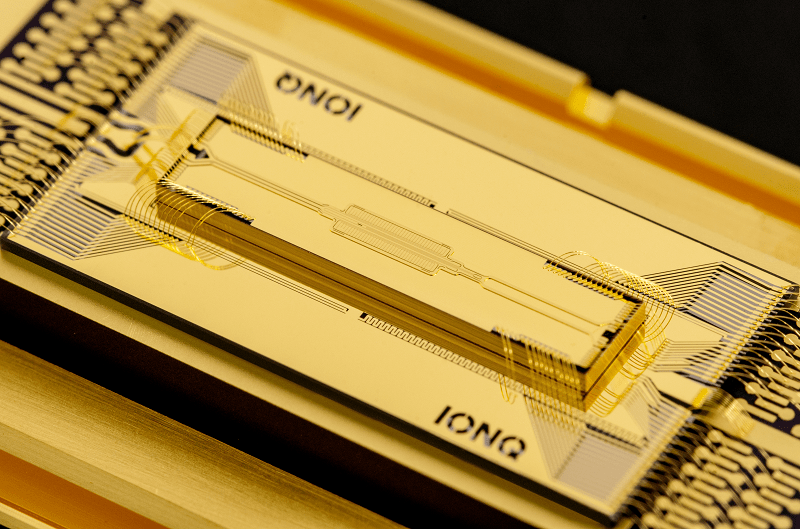

IonQ (IONQ): The Pursuit of Perfection (Trapped Ions)

- The Technology: IonQ utilizes trapped-ion technology. Qubits are individual atoms suspended in a vacuum chamber using electromagnetic fields and cooled to near absolute zero. Lasers are then used to manipulate and read the quantum states.

- The Advantage (Fidelity): By late 2025, IonQ remains the leader in qubit quality and fidelity (low error rates). This stability means the qubits can hold their quantum state longer, making them ideal for running complex algorithms without collapsing into errors. This high fidelity is non-negotiable for building the eventual fault-tolerant, universal quantum computer—the machine that can solve any problem. IonQ’s modular approach, allowing them to chain atoms together, offers a promising path to scaling without the debilitating crosstalk issues faced by some competitors.

- The Challenge: Despite the high quality, physically connecting these individual atoms reliably and rapidly into a massive, cohesive computing system remains a significant engineering hurdle.

Rigetti Computing (RGTI): The Scaling Challenge (Superconducting Circuits)

- The Technology: Rigetti uses superconducting circuits patterned onto silicon chips and cooled to millikelvin temperatures. This is the same fundamental approach employed by IBM and Google.

- The Advantage (Familiarity and Speed): This technology leverages existing silicon fabrication techniques, meaning that, theoretically, scaling up the number of qubits on a single chip can be faster and cheaper than constructing bespoke ion traps. Furthermore, superconducting qubits can operate at the high speeds necessary for quantum-classical hybrid algorithms, which are essential for near-term business utility.

- The Challenge: Superconducting qubits suffer from high decoherence (loss of quantum state) and require massive cryogenic infrastructure. Rigetti’s core innovation is its push toward a multi-chip interconnect—successfully stitching together several small QC chips into one massive system. While a success here would be game-changing for scalability, the market currently prices in the immense risk of perfecting this complex connection technology.

D-Wave Quantum (QBTS): The Specialized Practitioner (Quantum Annealing)

- The Technology: D-Wave’s processors are also superconducting but are built specifically for Quantum Annealing (QA), not universal computation. QA is not designed to run any algorithm; it is exclusively designed to find the lowest energy state in a complex system, making it perfect for optimization problems.

- The Advantage (Commercial Readiness): D-Wave has been the “first to market” for years. Its machines are commercially deployable right now and are proven to find better solutions to complex optimization problems than classical computers in specific, high-dimensional contexts. They are the clear leaders in commercial application today.

- The Challenge: Quantum Annealing is not a universal quantum computer. While powerful for its niche, it cannot run the breakthrough algorithms required for materials discovery or factoring large numbers, limiting its long-term, disruptive potential in the eyes of many growth investors.

2. The Money Today: Client Portfolios and Stable Revenue (Oct 2025)

In this pre-profit industry, “stable revenue” often means predictable, recurring fees derived from established utility, rather than volatile grants or milestone payments.

D-Wave: The Revenue Leader

D-Wave’s business model delivers the most predictable income of the three:

- Revenue Source: D-Wave generates revenue primarily through subscription access to its Leap cloud platform, professional services, and joint development programs with commercial partners.

- Client Portfolio: The portfolio is defined by organizations with massive logistical and planning needs. Expect a continued focus on financial services (portfolio optimization), logistics (DHL, major shipping companies), and government clients (DoE, defense contractors) using QA for scheduling and complex resource allocation.

- Verdict: D-Wave has the most stable revenue. Customers pay recurring fees because the technology provides tangible, incremental value right now. While the total revenue figure may be lower than IonQ’s best contract years, the stability is unmatched in this peer group.

IonQ: The High-Contract Growth Driver

IonQ’s revenue growth is explosive but is often characterized by massive, multi-year contracts that hit the balance sheet in large, uneven increments.

- Revenue Source: Large, government contracts (e.g., Department of Defense, NASA) for R&D on fault-tolerant systems, and substantial cloud access agreements with the major tech platforms (AWS, Azure, GCP).

- Client Portfolio: IonQ has likely deepened its relationship with large corporate R&D divisions (Hyundai, Airbus) focusing on materials design and with academic institutions demanding the highest fidelity systems. Their revenue is dictated by securing high-value, long-term deals.

- Verdict: Fastest growing revenue, but less stable. If a key government contract is delayed or renegotiated, revenue visibility for the next quarter can instantly drop.

Rigetti: The Project-Based Innovator

Rigetti’s revenue often aligns closely with research milestones and government grants focused on hardware innovation.

- Revenue Source: Mostly non-recurring engineering (NRE) contracts, government grants (especially from defense agencies interested in the scaling potential), and limited cloud access fees.

- Client Portfolio: Highly focused on partnerships that leverage their chip fabrication facility, such as defense contractors seeking custom hardware and national laboratories focused on hybrid classical-quantum solutions.

- Verdict: Lowest and most volatile revenue. Rigetti is still heavily in the R&D funding stage, meaning revenue is highly susceptible to external grant and project schedules.

3. The Sustainability Dividend: Quantum’s Green Added Value

Your core interest lies in how these solutions will contribute to sustainability, carbon footprint reduction, and green energy. This is where quantum computing transitions from a tech curiosity to a crucial global asset. All three companies, regardless of architecture, will provide immense value in the future, though their specific contributions differ.

Materials and Carbon Footprint Reduction (IonQ & Rigetti)

The single biggest environmental impact of universal QC will come from materials science.

- Battery Revolution for Green Energy: Current battery technology (mostly Lithium-ion) is reaching its theoretical limit. Quantum computers will simulate molecular and material interactions at an atomic level, allowing researchers to design entirely new battery chemistries—such as solid-state electrolytes or metal-air batteries—that are safer, denser, charge faster, and are built from more abundant, less environmentally damaging elements. This breakthrough is essential for making renewable energy storage viable on a continental scale, significantly reducing reliance on fossil fuel peaking plants.

- Catalysts for Carbon Capture: Quantum machines will accelerate the discovery of new, highly efficient catalysts needed for Direct Air Capture (DAC) technology. Finding a catalyst that can cheaply and quickly pull

out of the atmosphere requires modeling complex chemical reactions that are intractable for even the world’s best supercomputers. Quantum computing provides the necessary computational power to unlock this final frontier of carbon mitigation.

- Sustainable Fertilizers: Ammonia production for nitrogen fertilizer currently accounts for 1-2% of global energy consumption. A quantum computer could simulate the natural nitrogen-fixing process used by bacteria, leading to the design of new, highly efficient catalysts that produce fertilizer with dramatically less energy input, shrinking agriculture’s massive carbon footprint.

Optimization and Energy Savings (D-Wave)

D-Wave’s specialized technology provides near-term benefits centered on saving energy through efficiency.

- Smart Grid Optimization: D-Wave’s Quantum Annealers are already being tested to optimize the smart grid—balancing fluctuating power inputs from solar and wind farms with dynamic consumer demand. Efficient energy flow reduces waste, minimizes system strain, and helps integrate higher percentages of intermittent green energy sources without causing blackouts.

- Logistics Decarbonization: Optimization is crucial for reducing fuel consumption. By providing faster, more precise solutions for routing delivery fleets, scheduling container ships, and minimizing empty travel time, quantum annealing can directly translate to lower fossil fuel consumption and reduced carbon emissions across global supply chains.

4. The Investment Verdict: Five-Year Outlook (2025–2030)

Identifying the “most promising” investment involves balancing the risk of failure (technology) against the reward of market dominance (scalability). Given the current technological landscape in late 2025, we recommend a split strategy: IonQ for the long-term technological promise and D-Wave for stability and near-term market relevance.

Most Promising Technology: IonQ (IONQ)

- Thesis: Over the next five years, the market will increasingly reward the company that has the clearest path to universal fault-tolerant QC. IonQ’s Trapped-Ion architecture currently offers the highest fidelity, which is a non-negotiable metric for the commercial breakthroughs promised in materials science and pharmaceutical development.

- Outlook: While the path will be volatile, IonQ is projected to continue hitting key qubit-count and algorithmic performance milestones. By 2030, a functional, general-purpose quantum machine will begin to emerge, and the company with the lowest error rates (IonQ) is best positioned to lead this transition. This superior technology makes it the most promising long-term investment.

Most Promising for Stable Revenue: D-Wave (QBTS)

- Thesis: D-Wave offers a vital counterbalance to the speculative nature of universal QC. As the only company with established, recurring revenue from genuine commercial utility, it represents the most financially stable option in this group.

- Outlook: Over the next five years, D-Wave will continue to expand its niche optimization market, signing up new clients in finance, logistics, and manufacturing. This stable revenue base provides a floor that the highly volatile stocks of IonQ and Rigetti often lack. For risk-averse quantum investors, D-Wave offers the ability to participate in the quantum revolution while benefiting from current, real-world utility.

The Undervalued Asset: Rigetti Computing (RGTI)

- Thesis: Rigetti carries the highest risk but also the highest immediate potential for a valuation surprise. If, over the next 18-24 months, Rigetti can definitively prove the success of its multi-chip scaling architecture—solving the immense challenge of connecting several superconducting chips with high fidelity—the market will suddenly price them as a legitimate, scalable rival to the giants of the superconducting world.

- Outlook: Rigetti remains the underdog, but achieving a major, verifiable scaling milestone would make it the most significantly undervalued stock based on its current low market capitalization relative to its potential reward.

The Core Challenge: Quantum is Not Software

So, why don’t the tech giants just build the best system, undercut the little guys, and dominate?

The answer is complex, rooted in the difference between engineering dominance (where Google excels) and fundamental physics breakthroughs (where no one has a guaranteed lead).

Google, Amazon, and NVIDIA dominate the world of classical computing and software. In those fields, a large budget and superior engineering talent almost always guarantee the best solution.

Quantum computing is different. It is fundamentally a problem of physics and material science, not just code and server racks.

1. The Architectural Risk Factor

The biggest problem facing the QC industry is that no one knows which physical technology will win. This is often called the “Architectural Risk.”

- Google’s Bet: Google is heavily invested in Superconducting Qubits (the same basic tech as Rigetti). They have poured billions into it and have achieved major scientific milestones.

- IonQ’s Bet: IonQ believes Trapped Ions are superior because they offer lower error rates.

If Google spent $50 billion and perfected a superconducting chip, only to have IonQ’s ion trap prove fundamentally superior for scaling to millions of qubits, that $50 billion would be wasted.

Google and AWS cannot afford to bet everything on one scientific horse. Instead, they employ a strategy of Architectural Diversification.

2. The Cloud Giants’ True Goal: Platform Dominance

AWS and Google’s primary business goal is not to be the sole hardware provider but to be the indispensable access platform for all computing.

They want you to come to AWS Braket or Google Cloud regardless of the type of problem you need to solve—whether it requires a classical supercomputer, Google’s proprietary quantum chip, or IonQ’s unique Trapped Ion system.

| Scenario | Strategic Outcome |

| If IonQ wins the QC race… | AWS and Google still collect access fees from every user running a job on IonQ’s machine via their cloud platform. They win. |

| If Google’s chip wins… | They make money directly from their own hardware and still collect platform fees. They win. |

| If Rigetti’s chip wins… | AWS and Google can plug it into their cloud and collect fees. They win. |

By partnering with all the major hardware builders, the cloud giants eliminate the risk of betting on the wrong science and guarantee that the customer is running the workload on their platform. They turn their competitors’ hardware into a feature of their own service.

3. The Competition is Real, But Focused

The competition between the hardware companies (IonQ, Rigetti) and the cloud giants (Google’s internal quantum team) is intense, but it occurs primarily in research and talent acquisition, not in the marketplace today.

The Duel for the “Better Solution”

Google absolutely wants to offer a better solution, and they are spending enormous sums to do so. Their internal efforts are highly competitive, especially against Rigetti in the superconducting space.

However, because the science is so difficult, they cannot guarantee a lead. The breakthroughs often come from small, specialized teams with unique IP (like IonQ’s ion trapping techniques, which evolved from years of academic research).

The competition is less about who has the most revenue and more about who achieves the next major scientific milestone first:

- Who builds the first qubit with 99.9999% fidelity (low error rate)?

- Who finds the first scalable method for creating 1 million connected qubits?

This is a race of fundamental physics, where the small, focused teams often have an advantage in innovation speed and IP concentration over the large, bureaucratic tech giants.

NVIDIA’s Unique Role

NVIDIA is different again. They are positioning themselves to be the indispensable provider of the classical infrastructure needed to make quantum algorithms work.

- Most practical quantum algorithms are hybrid: they use a quantum processor for a small, intractable part of the problem, and a powerful classical supercomputer (powered by NVIDIA GPUs) for the rest.

- NVIDIA competes by ensuring that no matter who wins the hardware race (IonQ or Google), you will still need to buy their high-powered hardware and software tools to run the surrounding hybrid algorithm.

In short: The small companies build the “engine” (the quantum chip), and the tech giants provide the “chassis” (the cloud platform) and the “gas pedal” (NVIDIA’s classical compute). They are partners in the ecosystem but fierce rivals in the laboratory.

5. The Quantum Imperative

The investment case for these three companies is fundamentally a belief in the necessity of exponential computation to solve exponential environmental crises. The challenge of achieving net-zero by 2050 requires breakthroughs that classical computers simply cannot deliver. Whether through IonQ’s perfected materials simulation, Rigetti’s scalable architecture, or D-Wave’s immediate logistical optimization, quantum computing is an essential tool in the sustainability toolbox.

For investors, the quantum sector demands patience and a high tolerance for risk. We are buying into the research and the dream of a future defined by clean energy and optimized planetary resource use. The choice between D-Wave, Rigetti, and IonQ is not about picking a winner, but about aligning your capital with the specific stage of the quantum revolution you believe is closest to delivering critical, climate-saving value.

Call to Action: Betting on Breakthroughs

We recommend a balanced approach: secure a foundation in the stability of D-Wave‘s proven utility while aggressively investing in the long-term, high-fidelity promise of IonQ. Maintain a small, speculative position in Rigetti, recognizing its huge, undervalued upside if its scaling challenges are overcome. The fate of the quantum sector, and perhaps the future of the climate, hinges on their success.

Related Video

Related Content

- IonQ 2025 Q3 Investor Report: Ion Trap Fidelity and Path to Fault Tolerance

- Google’s Willow: A Leap Forward in Quantum Computing with Profound Ecological Implications

- The Road to Quantum Supremacy: Breakthroughs and Implications

- Quantum Computing: The Next Frontier in Technology and Innovation

- A new design for quantum computers

- The Rise of Quantum Computing: Implications for Security, Business, and Technology

- Beyond Entertainment: How Google’s Genie 3 Could Become the Simulator for Our Climate Future

- What’s driving the surge in quantum stocks this week

- Rigetti – Create new opportunities with tomorrow’s most advanced computing technology

- Quantum Computing Stocks Jump — Rigetti, D-Wave, IonQ Lead Sector Rally

- Quantum Computing Stock Could Rise 67%, Says Analyst. Here’s Why. – Barron’s